[ad_1]

Fisker announced that its talks with a “large automaker” for a potential investment have fallen through. Trading has been halted on Fisker stock (FSR), and NYSE is moving to delist the stock.

Things have been rough for Fisker in the last few weeks. After a Q4 wherein the company had big delivery growth but nevertheless said there was “substantial doubt” it could continue as a going concern without significant outside investment, the stock has fallen significantly from already-low levels.

And last week, the company missed an interest payment and paused EV production while it sought to sell down some of its ~$530 million in inventory (it’s trying to use existing dealerships to do so). Fisker vehicles are produced through contract manufacturing, by veteran manufacturer Magna Steyr.

There was potential that Fisker might find the outside investment it sought, though, as rumors were that Nissan was looking to partner with the company.

In August, Fisker showed off the Alaska concept, a mid-size pickup truck which seems to fit a similar niche as the Nissan Frontier. If Nissan were looking for a relatively cheap company to acquire or invest in, in order to electrify its Frontier segment, this could be a way to jump-start that vehicle program.

Fisker had never named the “large automaker” in question, though Nissan was the main target of rumors. Nissan separately introduced a new EV business plan Monday, with no mention of Fisker.

The “large automaker” talks had buoyed Fisker stock after large falls in recent days. Earlier this month it was reported that Fisker had hired outside consultants to discuss options for the company, including potential bankruptcy. That sent the stock tumbling by over 50%, but it recovered significantly the next day when Fisker reiterated that it had still been in talks with a large automaker.

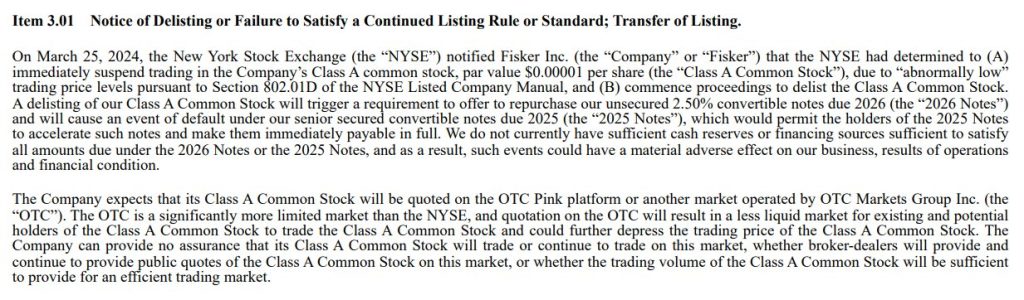

But today, Fisker said that its talks with a large automaker for a potential deal have collapsed. Shares fell 30% before trading was halted, and at the time it was noted that “an announcement is pending.” We now know that that announcement is from the NYSE, which is moving to delist the stock – a move which NYSE warned was possible last month.

The stock delisting means that Fisker stock (FSR) will no longer be available on the NYSE, though might be available through OTC markets. It also has ramifications for Fisker’s upcoming 2025 and 2026 convertible notes – it will be required to repurchase the 2026 notes and will default on the 2025 notes, according to Reuters.

Electrek’s Take

Some have blamed Fisker’s recent troubles on a negatively-titled review from tech reviewer MKBHD which was widely viewed, but the concerns shared by MKBHD were not unique. I shared many of the same concerns when I got the car for a 24-hour review back in November (though with a less-negative title), and the other journalists who I spoke with after that review shared similar concerns.

The general opinion I’ve heard from each auto journalist I’ve talked to about the car, save one or two, is that it’s quite unfinished. There might be something there after lots of work on the software, but the flaws are significant, with most of us having large bullet point lists of necessary improvements before the car can meet a good baseline.

Fisker’s upcoming concepts, particularly the Fisker PEAR, look quite promising, and the company’s focus on sustainability is much more serious than many others in the automotive industry. Its contract manufacturing business plan is interesting, especially for a startup that’s trying to run “asset light,” not requiring billions or tens of billions in order to get production up to speed.

But these recent troubles put Fisker’s chances to pull through and bring those future vehicles to market significantly lower.

FTC: We use income earning auto affiliate links. More.

[ad_2]

Source link